| UCP 600 A guide to major rules and regulations governing letters of credit. | |

| |

| For

information about our other e-learning solutions see Course

Catalog | |

| |||||

|

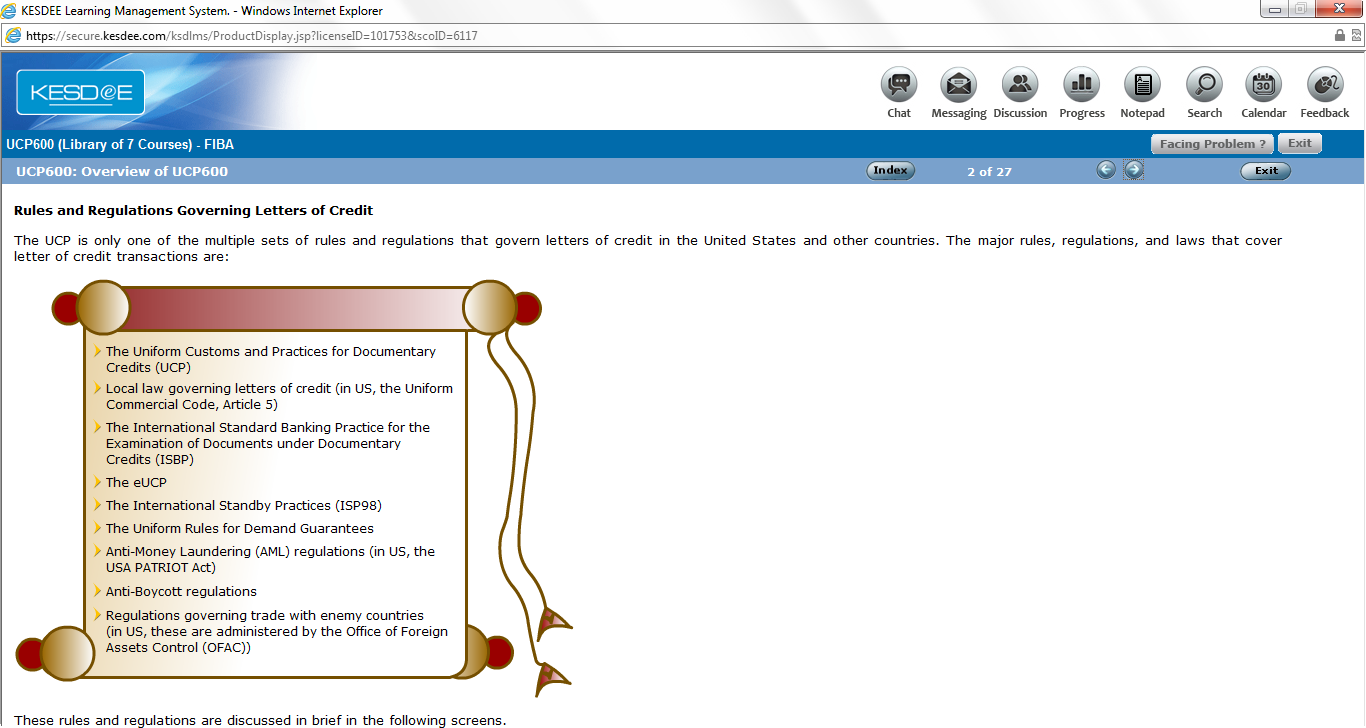

This course library discusses major rules and regulations governing letters of credit. This takes through different articles set in UCP 600 with respect to their applicability and functionality in different situations. This course also discusses the rules relating to aspects and value of the documentation along the process of letters of credit. Target Audience

This course has relevance to all parties involved with letters of credit but is especially aimed at exporters. The course highlights the changes that will have the greatest impact on letter of credit beneficiaries. Course Level and Number of Courses Basic to Intermediate. Library of 7 Courses Instructional

Method Audio Clips: Voice over of the concepts providing a classroom atmosphere. To purchase this course online, visit: Link | |

| UCP

600 Time taken to complete each Course: One hour 1. UCP600 An Overview

2. Part 1

3. Part 2

4. Part 3

6. Part 5

7. Part 6

| |

| For

more information about our e-learning products and services visit us at www.kesdee.com |

|

|